Australian Gymnastics Cdependent Care Fsa Limits 2025

BlogAustralian Gymnastics Cdependent Care Fsa Limits 2025 - Who is a qualifying dependent? It lets you set aside pretax dollars to pay for certain child and adult care services — services that. Australian Gymnastics Cdependent Care Fsa Limits 2025. On november 9, 2025, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits. For 2025, the fsa annual salary reduction limits.

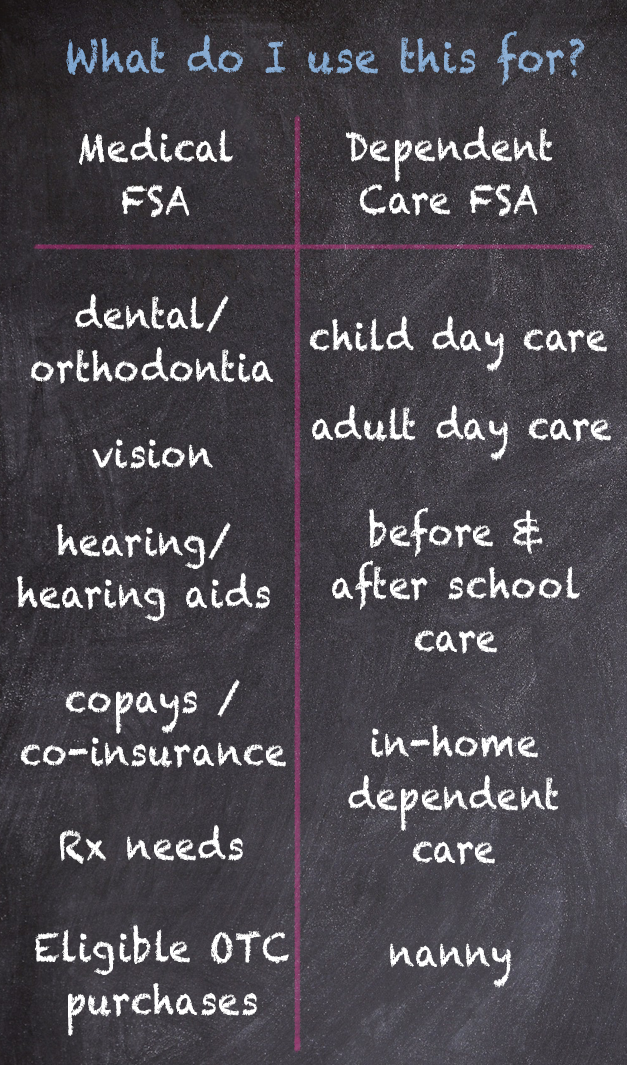

Who is a qualifying dependent? It lets you set aside pretax dollars to pay for certain child and adult care services — services that.

2025 Limited Purpose Fsa Contribution Limits 2025 Ranee Casandra, A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account.

Dependent Care Fsa 2025 Contribution Limits Irs Rubi Wileen, Get ready to experience australia’s best gymnasts vying for the title of 2025 australian champion.

Fsa Contribution Limits 2025 Dependent Care Benefits Elna Zonnya, A dependent is defined as someone who spends at least 8 hours a day in your home and is one of the following:

2025 Fsa Dependent Care Limits Carri Cristin, The 2025 dependent care fsa contribution limit is $5,000 for single.

Annual Dependent Care Fsa Limit 2025 Married Lacey Aundrea, • a tax dependent child under the age of 13 for.

Dependent Care Fsa Limit 2025, The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

Dependent Care Fsa Limit 2025 Increase Manda Rozanne, It remains at $5,000 per household or $2,500 if married, filing separately.

Dependent Care Fsa Limit 2025 Irs Esther Roxanne, Join our short webinar to discover what kind of expenses.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

Irs Dependent Care Fsa 2025 Jayme Loralie, On november 9, 2025, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.