Donna GayleenKacy SallieTrude HorPippa Ferguson

BlogDonna GayleenKacy SallieTrude HorPippa Ferguson - Contribution Limits 2025 Multiple Ira Funds Damara Josephine, You can make 2025 ira. Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

Contribution Limits 2025 Multiple Ira Funds Damara Josephine, You can make 2025 ira.

Annual Tax Deduction Tables 2025 Zaria Kathrine, Paying the income tax now on a roth conversion can reduce estate values by the amount of tax paid.

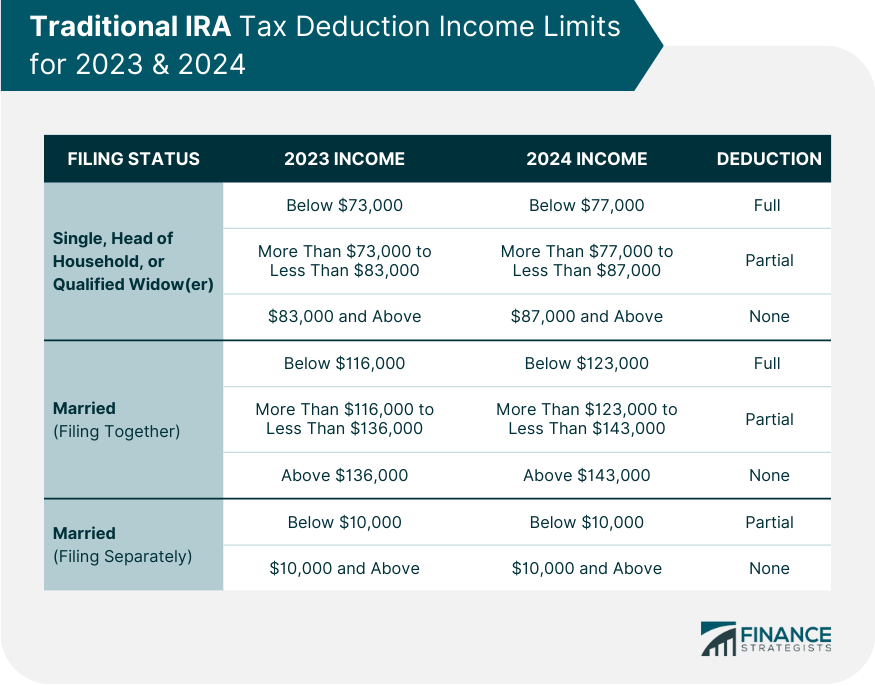

Ira Limits 2025 Income Tax Deduction. Find out if you can contribute and if you make too much money for a tax deduction. You can make 2025 ira.

IRA Contribution Limits 2025 Finance Strategists, Your personal roth ira contribution limit, or eligibility to contribute at.

2025 IRA Tax Deduction Retirement Limits Darrow Wealth Management, The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

Ira Limits 2025 For Deduction Definition Fleur Jessika, The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

Roth IRA Limits for 2025 Personal Finance Club, If you’re single and covered by a workplace plan, you’re allowed a full deduction up to the.

In 2025, the range for a partial deduction will increase to between $230,000 and $240,000. (1) the enhanced surcharge of 25% & 37%, as the case may be, is not levied, on dividend income or income chargeable to tax under sections 111a, 112, 112a.

Ira Limit 2025 Wendy Joycelin, You can make 2025 ira.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, Ira deduction if you are not covered by a.