Mortgage Rates In Canada 2024

BlogMortgage Rates In Canada 2024 - Mortgage Rates In Canada 2024. The canadian real estate association (crea) 2024 home sales forecast: The market consensus on the mortgage interest rate forecast in canada is for the central bank to hold rates at 5% in june, then cut by 0.25% on july 24, with a full 0.50% of cuts. About the same as the national average. The bank of canada will not increase rates further and will cut rates by 50 to 100 basis points in the second half of 2024.

Mortgage Rates In Canada 2024. The canadian real estate association (crea) 2024 home sales forecast: The market consensus on the mortgage interest rate forecast in canada is for the central bank to hold rates at 5% in june, then cut by 0.25% on july 24, with a full 0.50% of cuts.

Mortgage Rates Forecast 2024 Canada To Cash in 24, Canadian mortgage rate forecast 2024. The canadian real estate association (crea) 2024 home sales forecast:

Lowest fixed and variable mortgage rates in Canada for May 5 2023 The, Today's current mortgage rates in canada. After nearly two years of interest rate increases, cuts may be on the horizon—here’s what that means for.

Commercial Mortgage Rates Canada 2021, Bank of montreal (bmo) learn more. About the same as the national average.

Compare 5yrs Variable Vs Fixed Mortgage Rates In Canada As Of March 2024, Both fixed rates and variable rates experienced increases over the first three quarters of the year, with the fixed rate starting to decrease for the. After nearly two years of interest rate increases, cuts may be on the horizon—here’s what that means for.

Learn about trends and factors that impact your mortgage rates.

Want a printable comparison spreadsheet you can update and add to whenever.

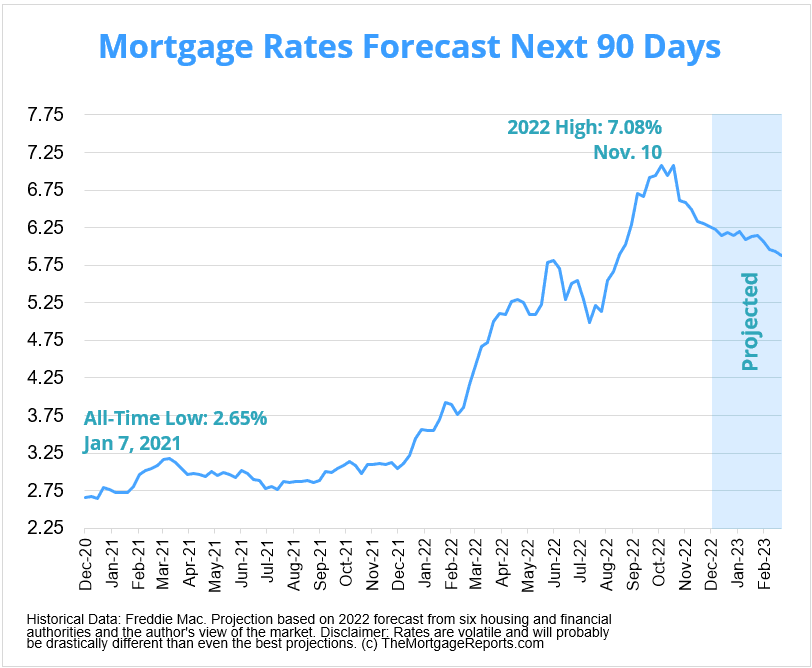

Mortgage Rates Forecast Will Rates Go Down In January 2023?, Which should you choose in 2024? So if you are shopping for a mortgage, 5% is a very attractive rate depending on the term and features of your mortgage.

BMO Mortgage Rates In Canada As Of March 2024, Compare mortgage rates from lenders across canada. Bank of montreal (bmo) learn more.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/JA4DRQJQXJPSBIIPSZTQZFMMQU.jpg)

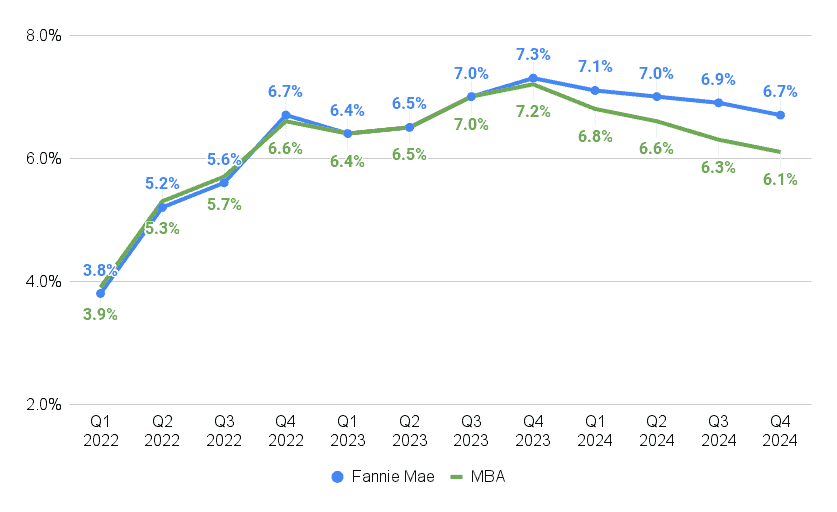

Economists Now Less Certain 2024 Will Bring Mortgage Rate Relief Inman, Updated may 16, 2024 advertiser disclosure. Inflation in canada is currently 2.9%.

Fixed Mortgage Rates In Canada As Of March 2024, Why did variable rates go up so much in 2022 and. What’s in store for mortgages in 2024?

10 Year Fixed Mortgage Rates Canada 21 Gobal creative platform for, Bank of montreal (bmo) learn more. Learn about trends and factors that impact your mortgage rates.

Currently, canada’s interest rate environment is such that advertised mortgage rates range from 4.8% to over 7.5%.

Monday Mortgage Update March 12, 2012 Ratehub.ca, Fixed or variable mortgage rate: The market consensus on the mortgage interest rate forecast in canada is for the central bank to hold rates at 5% in june, then cut by 0.25% on july 24, with a full 0.50% of cuts.